Submitted by: Eric Woodie, ISA Trade Analyst

The 2024/2025 soybean marketing year was defined by change. Shifting trade relationships, policy uncertainty and increased global competition created notable headwinds for U.S. soy — particularly with our largest customer, China. Even so, the year closed with clear signs of resilience, underscoring the importance of market diversification and the growing strength of the full U.S. soy complex.

Drawing on year-end trade data and market analysis, this review highlights how U.S. soybeans, soybean meal and soybean oil performed in 2025 and what these trends mean for producers and the broader soybean industry.

Whole Soybeans: Strong Volumes Despite Market Shifts

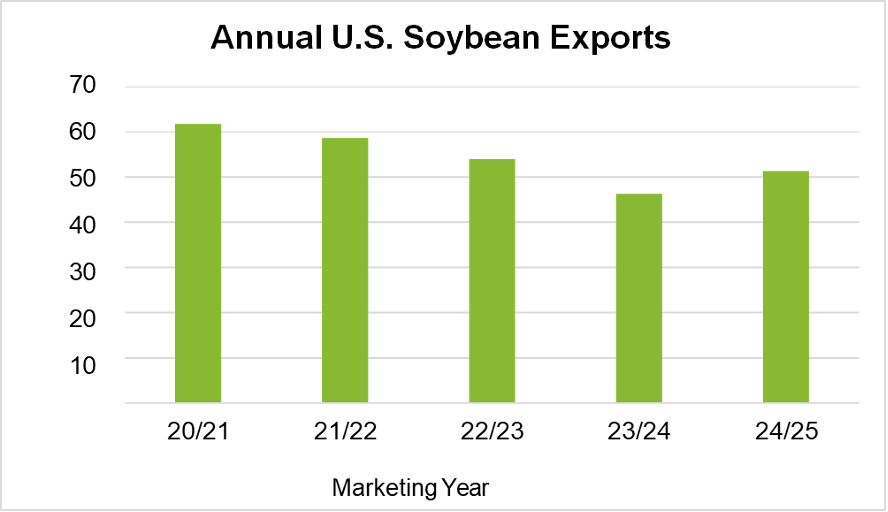

Total U.S. soybean exports for the 2024/2025 marketing year reached 51.2 million metric tons (MMT), finishing 11% higher than the previous year. While overall volumes increased, the composition of export markets shifted significantly.

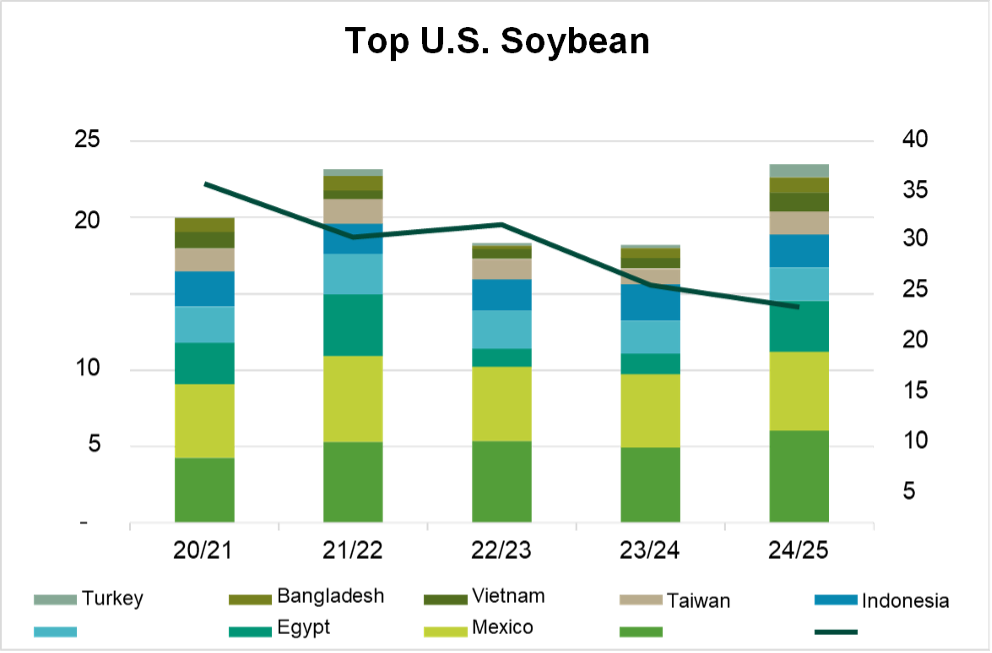

China remained the largest destination for U.S. soybeans at 22.6 MMT, but exports declined 9% year-over-year. The marketing year started off strong before facing additional tariffs and increased competition from South America. These factors reinforced the need for diversified export markets to offset fluctuations in demand from any single buyer. That diversification was evident with the European Union importing just over 6 MMT, a 23% increase from the previous year, followed by Mexico at 5.21 MMT. Several emerging and rebuilding markets also recorded gains, including Egypt (3.34 MMT, up 23%), Japan (2.17 MMT), Indonesia (2.16 MMT), Taiwan (up 48% to 1.51 MMT), Vietnam (up 82% to 1.26 MMT), Bangladesh (up 53% to 989 TMT) and Turkey (up 331% to 827 TMT).

Market Spotlight: Egypt

Market Spotlight: Egypt

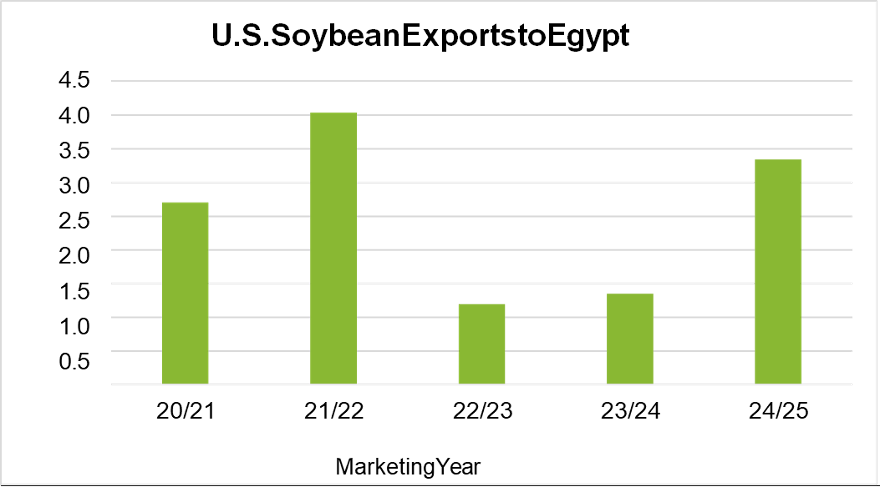

Egypt stood out as a key success story during the 2024/2025 marketing year. After two sluggish years driven by currency challenges, U.S. soybean exports rebounded, more than doubling from the prior year to reach 3.34 MMT of U.S. soybeans. Growth in Egypt continues to be driven by expansion in the domestic crush sector, supported by strong demand for soybean meal from the poultry industry. USDA estimates indicate Egyptian crush capacity is expected to expand by another 5% in the 2025/2026 marketing year. Over the past five years, the U.S. has maintained an average market share near 70%, reflecting the value placed on the consistency and reliability of U.S. soybeans.

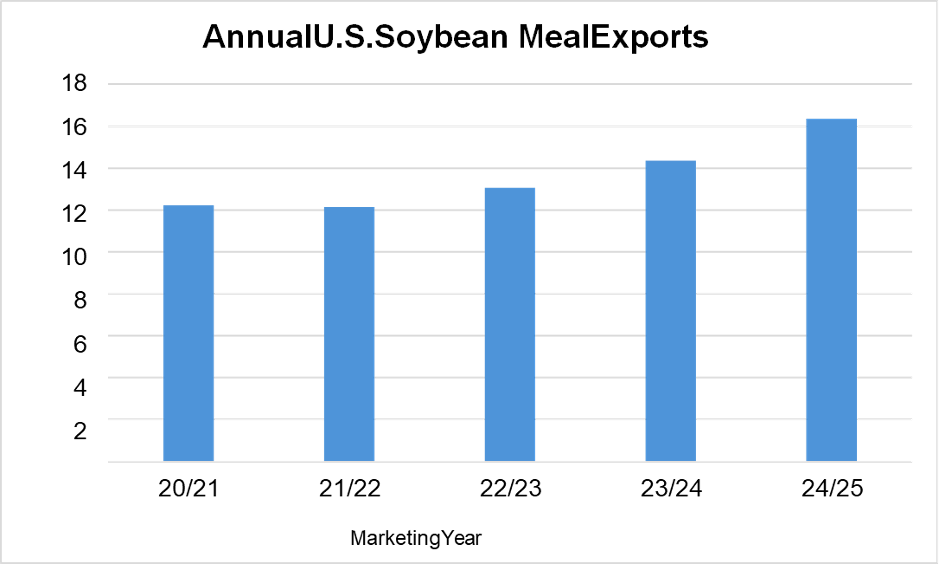

Soybean Meal: Record Exports and Expanding Demand

Soybean meal exports delivered another record-breaking year. During the 2024/2025 marketing year (October–September), the U.S. shipped 16.4 MMT of soybean meal valued at more than $6 billion. This marked a 14% increase over the previous record and stood 27% above the five-year average.

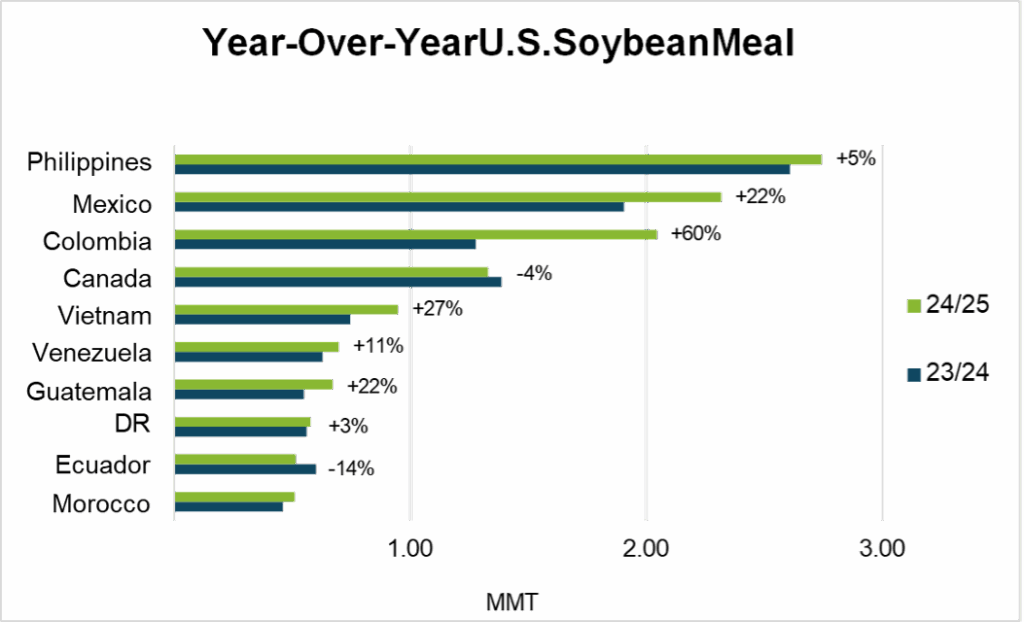

The Philippines retained its position as the largest importer at 2.74 MMT, followed by Mexico (2.32 MMT) and Colombia (2.04 MMT). Additional top markets included Canada (1.33 MMT), Vietnam (946 TMT), Venezuela (696 TMT), Guatemala (670 TMT), the Dominican Republic (577 TMT), Ecuador (515 TMT) and Morocco (510 TMT). Several markets showed especially strong growth relative to their five-year averages. Bangladesh was a notable standout, recording more than 600% growth over the past five years, largely driven by investments in feed manufacturing and protein production.

U.S. Crush: Policy-Driven Demand and Record Volumes

The U.S. soybean crush sector also reached new records in 2025, largely fueled by domestic demand for soybean oil tied to policy incentives. Several months during late 2025 set new crush records, pushing total marketing-year crush volumes to 73.9 million metric tons. Strong crush demand not only supported soybean prices domestically but also played a critical role in enabling increased exports of soybean meal and oil — further highlighting the value of the integrated soy complex.

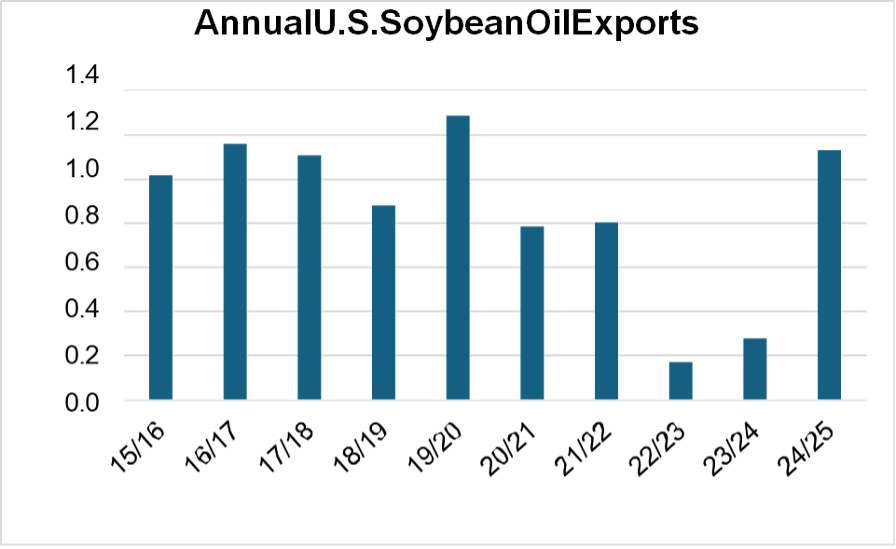

Soybean Oil: Volatility and Opportunity

Soybean oil exports rebounded sharply during the 2024/2025 marketing year, increasing more than 4 times to 1.13 MMT. Early policy uncertainty in 2025 led to increased imports of alternative biofuel feedstocks, which temporarily pressured soybean oil exports. Clarification later in the year shifted market dynamics once again. Top destinations for U.S. soybean oil included India, Mexico, Colombia and Venezuela, with India’s role as the world’s largest vegetable oil importer creating new opportunities as global supply dynamics shifted.

The Bigger Picture: A Diversified Path Forward

Preliminary USDA data from December 2025 shows total exports of the U.S. soy complex — whole beans, soybean meal, and soybean oil — reached 68.7 MMT, a 12.8% increase over the previous year and above both the five- and ten-year averages. The standout story of the year was growth beyond whole soybeans. Soybean meal exports reached 16.3 MMT, nearly 14% higher year-over-year, while soybean oil shipments climbed 304% from the previous year to 1.1 MMT, the highest levels seen in years.

While China remains a critical market, the 2024/2025 marketing year reinforced the value of diversification. Expanding demand in countries such as Vietnam, Venezuela, Colombia, Bangladesh and Turkey reflects investments in crush capacity, modern feed industries and growing protein consumption. Quality, reliability and sustainability continue to define the U.S. soy advantage — positioning U.S. soy to compete effectively even as global markets evolve.