Trade Analyst, Eric Woodie, recently submitted a soybean market update that covers the changes in soybean exports and imports in the recent marketing year.

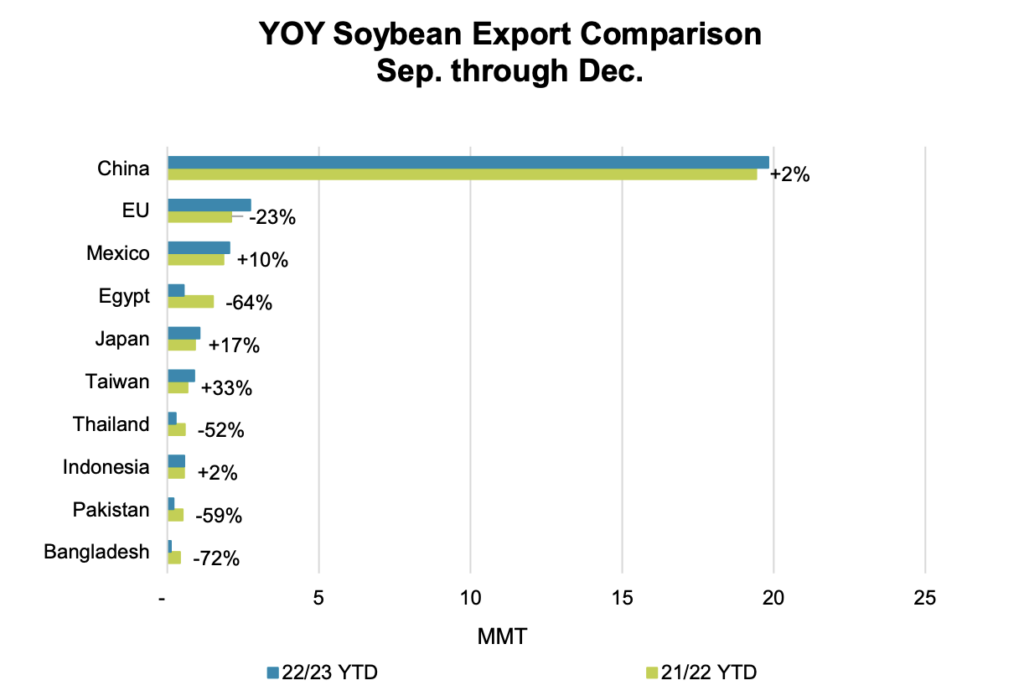

Whole Bean Review

According to Woodie, total year-over-year exports of whole soybeans are down nearly 5 percent compared to last year at 29.7 million metric tons (MMT). Egypt has seen a 64 percent decline in soybean imports, but the Egyptian government recently released 2.5 MMT of agricultural imports that had been on hold since September of 2022. So, it remains to be seen whether or not these export volumes have declined as much as initially reported.

Due to decreases in exports to Germany, Spain, and Portugal, the European Union (EU) is down from 2.73 MMT last marketing year to 2.11 MMT this year. The low export volumes were mostly caused by declining crush volumes that have since begun to recover. In fact, EU crush volumes increased 32 percent in December after a slow start from September through November.

Taiwan has made a noticeable decline, dropping year-over-year from 580 thousand metric tons (TMT) last year to 278 TMT so far this year. Year-to-date totals for Pakistan (206 TMT) and Bangladesh (118 TMT) are also down significantly from year-to-date totals last marketing year.

While there has been a decline in soybean imports in many countries, several of the top 10 markets have seen an increase in year-over-year volumes. Mexico has seen an increase of 200 TMT, Japan’s soybean imports have increased by 145 TMT, and Taiwan has had the largest increase of 217 TMT.

Woodie also provided a 5-year look into some of the top importers of soybeans. In his report, he stated that over the past five years, the EU has been the only top five market whose 2021/22 export volumes did not exceed the previous five-year export average. From marketing year 2017/18, the EU has declined by 5.61 percent, while China has increased by 6.4 percent, Mexico increased by 29.2 percent, Egypt increased by 78 percent, and Japan increased 20.8 percent. In total, global soybean exports increased by 1.12 percent to 58.7 MMT for the 2021/22 marketing year compared to 58.1 MMT in marketing year 2017/18.

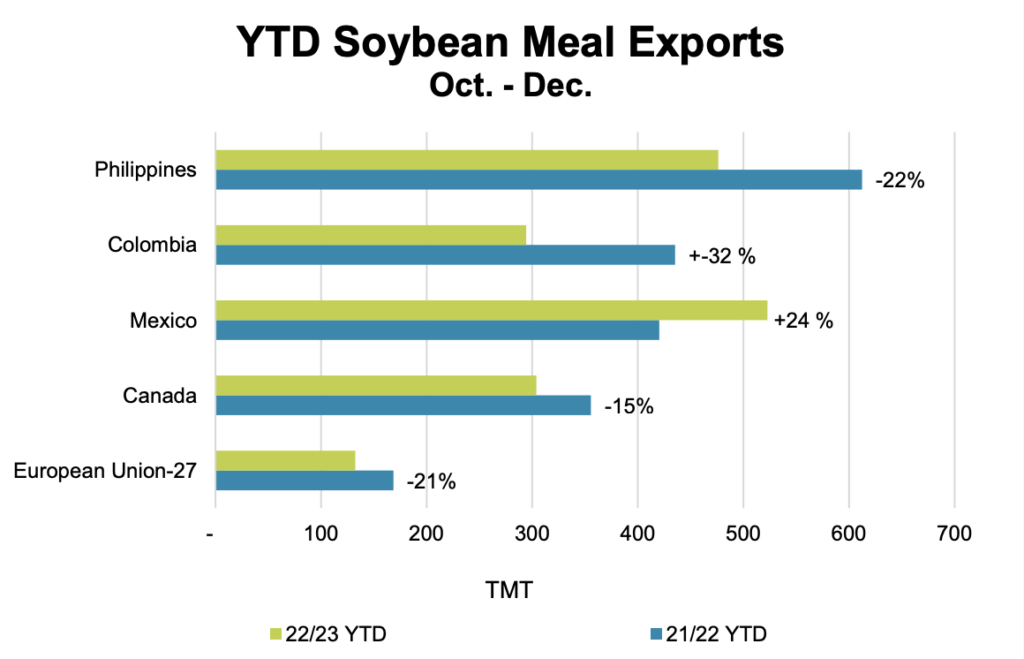

Soybean Meal Review

According to Woodie’s report, U.S. soybean meal exports have declined nearly 6 percent from 3.37 MMT last marketing year to 3.18 MMT this marketing year. Of the top five markets, all have seen substantial declines including the Philippines (136 TMT), Mexico (103 TMT), Canada (52 TMT) and the EU (36 TMT). Only Colombia has seen an increase, jumping 32 percent year-over-year from 420 TMT to 523 TMT year-to-date.

In marketing year 2021/22, exports to the Philippines were on-par with the preceding five-year average, while Mexico underperformed by approximately 150 TMT. Exports to Colombia exceeded the five-year average by 300 TMT and Canada outpaced the average by nearly 200 TMT. When rounding out the top five markets, Woodie found that the EU underperformed in marketing year 2021/22 compared to the five-year average by roughly 220 TMT. He stated that the lack of consistent available supply, strength of the USD, and overprice firmness have all contributed to this decline.

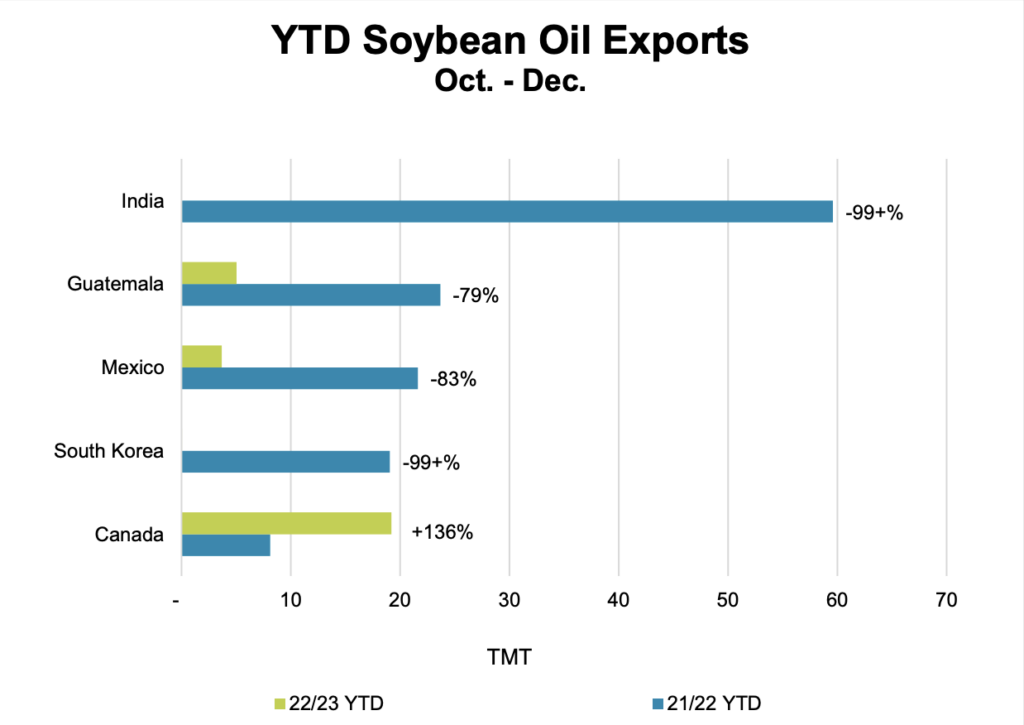

Soybean Oil Review

Year-to-date, total soybean oil exports are down 82 percent at 36.8 TMT compared to the 205 TMT last marketing year, and of the top five markets, the top four have all seen significant declines with India and South Korea having virtually zero sales year-to-date.

The report states that the only top five market to see an increase is Canada, increasing 136 percent to 19.2 TMT, and according to Woodie, this increase is due in part to larger domestic soybean oil consumption for use in renewable fuel. The year-over-year comparison tracks with a decline over the last five years in soybean oil exports. Since marketing year 2017/18, total exports have declined over 27 percent from 1.12 MMT to 804 TMT in 2021/22.